Certificates of Insurance Task

This document serves as a guide to completing TRCA’s Vendor or Contractor Certificate of Insurance (COI) form as well as requests for TRCA’s COIs. It includes a brief description on the purpose of a COIs, when COIs are required, processes for completing COIs as a part of the procurement process, and a step-by-step guide to filling in the COI request form.

- Download this guide

- Download TRCA’s Vendor or Contractor COI Request Form

- Download TRCA’s COI Request Form

- Download the Vendor or Contractor COI Submission Form

What is a Certificate of Insurance (COI)?

A certificate of insurance is a form, signed by an approved insurance representative that provides proof of insurance. The COI only serves as a declaration by the signing agency that insurance exists as described. It does not provide any additional insurance or represent a policy on its own. Typically a COI will include a listing of coverage types, limits of insurance, coverage dates, and policy numbers, information on the insurer as well as some terms and conditions related to the coverage.

Who are the parties on the COI?

It is a document issued to a Certificate Holder (the group asking for proof of insurance), that is endorsed by an insurance company (or broker) showing that insurance is indeed in place for the Named Insured party (the group that needs to prove it has insurance in place). Often the COI will show a party, often the Certificate Holder, as well as other third parties as Additional Insureds. An Additional Insured party, is one that is given certain rights to make a claim against the Named Insureds insurance policy, usually provided that the circumstances leading to the claim have arisen out of the operations of the Named insured.

Why do you need a COI?

A COI is usually required when TRCA is entering into an agreement with a third party. Examples include the hiring of contractors or consultants, entering into partnerships, the use of private property, and many others.

TRCA will usually request a COI from a third party to confirm that the third party’s insurance coverage is in place. A common example of when we would do this is when TRCA is hiring someone to do work or supply materials.

In some cases, TRCA will be required to provide a COI to a third party. This is often when TRCA is being hired to provide some sort of service.

For exact details on COI requirements staff should refer to the relevant agreement documents that are guiding their relationship with a third party.

What does this manual include?

This manual includes a step-by-step guide to completing both first and third party requests as well as information on integrating COI’s with TRCA’s procurement agreement database.

Two types of Certificates of Insurance

The two types of certificates of insurance include Vendor or Contractor COIs (formerly known as the “Third Party COI” and TRCA’s COI (formerly known as the “First Party COI”). The previous first-party and third-party certificates of insurance have been updated for simpler language to avoid confusion.

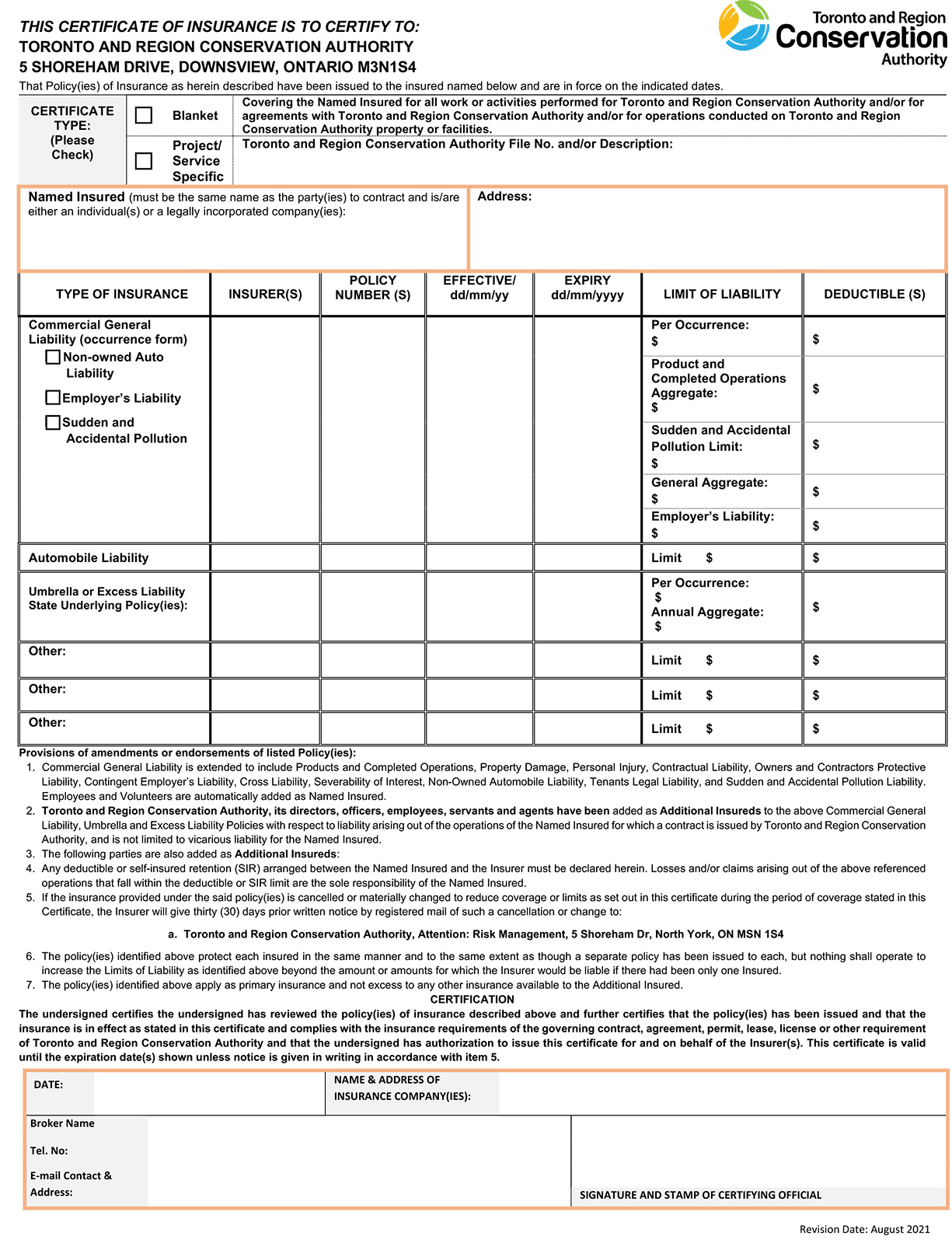

TRCA’s Vendor or Contractor COI is a fillable pdf, to be completed by third parties entering into contracts with TRCA and signed by their insurer. The COI verifies that the vendor or contractor has the insurance policy coverage as agreed upon and outlined by the contract. This protects TRCA from claims arising from the operations of the third party, and allows TRCA to receive compensation from the third party’s insurers should a claim arise. A full-size form is available in Appendix A. Section 5 outlines how to request a vendor or contractor COI.

TRCA’s COI is also a fillable PDF, but must be completed by TRCA staff when TRCA is entering into an agreement to perform works, services or use of another party’s property. In TRCA’s COI, TRCA is providing proof of insurance to a third party who has requested it. Section 6 outlines how to request a TRCA’s COI.

When is a COI required?

A COI is usually required when TRCA is participating in works, projects or operations with a third party. TRCA will almost always require a COI from contractors, vendors or service providers prior to contract signing or project start date. When a contractor works on another person’s property, there are risks involved. Contractors can sometimes damage personal property or may even be injured while performing the work. Companies and individuals that hire contractors want to be certain that they will not be held liable for injuries, damages or substandard work that the contractor might cause. Requesting a COI from a third party, along with properly completed contract documents, are important parts of ensuring that TRCA will not have to pay for these potential liabilities.

In some cases, TRCA will be required to provide a COI to a third party. This is often when TRCA is being hired to provide some sort of service or using a third party’s facility.

When is a COI not required?

Under some circumstances, a COI may not be required. Examples include if it is not a requirement in the contract, if TRCA is being hired as the contractor, or if in consultation with Risk Management it is determined that a COI is not required.

The Procurement and Agreement Management database facilitates TRCA procurement and agreements with third parties. The database also stores any Vendor or Contractor COI’s related to the agreement. COIs must be added to the corresponding agreement in the PO database.

The Procurement and Agreement Management database facilitates TRCA procurement and agreements with third parties. The database also stores any Vendor or Contractor COI’s related to the agreement. COIs must be added to the corresponding agreement in the PO database.

In the Procurement Agreement Database, the Certificate of Insurance must be added under the “Agreement Signature” tab. A copy of the COI must be attached, and the expiry date completed. The insurance expiry date will be the earliest insurance expiry date as shown on the contractor or partner’s COI. Please be aware that if your project or contract is expected to outlast the COI expiry, the procurement database will send you a notice to update the certificate. Staff are responsible for ensuring that a new certificate is requested and uploaded into the database during the term of the contract.

If a COI is not required, you must check off the appropriate box. A blank field will appear where you will then have to provide a reason as to why a COI is not required for this procurement.

3.1 What is TRCA’s Vendor or Contractor COI?

TRCA’s Vendor or Contractor COI is a fillable pdf, to be completed by third parties entering into contracts with TRCA and signed by their insurer. The COI verifies that the third party has the insurance policy coverage as agreed upon and outlined by the contract. This protects TRCA from claims arising from the operations of the third party, and allows TRCA to receive compensation from the third party’s insurers should a claim arise. A full-size form is available in Appendix A.

TRCA’s Vendor or Contractor COI is a fillable pdf, to be completed by third parties entering into contracts with TRCA and signed by their insurer. The COI verifies that the third party has the insurance policy coverage as agreed upon and outlined by the contract. This protects TRCA from claims arising from the operations of the third party, and allows TRCA to receive compensation from the third party’s insurers should a claim arise. A full-size form is available in Appendix A.

3.2 Types of Certificates

There are two types of Certificates – Blanket or Project. This option must be checked off in the top left corner of the COI form.

Blanket certificates are a single certificate that serves as proof of insurance for all works undertaken by the contractor. This should only be used by Vendors of Record or contractors who are providing services across multiple sites. TRCA will not accept a blanket certificate for “one-off” contracts.

Project/Service Specific certificates provide proof of insurance that is specific to an operation, contract or event.

3.3 File Number and Descriptions

In the space illustrated below, describe the specific event, project or property that the COI pertains to. This can include addresses, dates, agreement numbers (found in the Procurement and Agreement Management Database) or any other information that identifies the project or service to which the COI pertains. This section only needs to be completed for Project/Service Specific Certificates.

3.4 Named Insured and Address

The Named Insured is the person or company to whom the insurance policy has been issued. This will be the company or person that you are hiring or entering into an agreement with. This includes project partners, contractors, individuals, organizations, municipalities or regions. Their complete name goes in the left field, with their full address in the field to the right. The Named Insured must be exactly as shown in the contract documents.

3.5 Additional Insureds

An additional insured is a third party who is being added to the Named Insured’s policy, providing them with coverage if a claim arises as a result of the Named Insured’s operations. You will note that by Section 2 of the COI form TRCA is already listed as a party to be added as an Additional Insured. Section 3 provides room for any other parties that also need to be added. Your contract documents will specify which parties must be Additional Insured on the form and parties added as Additional Insured must be shown exactly as in the contract.

3.6 Certification

The bottom part of the COI, under Certification, is to be completed by the vendor or contractor’s insurer and broker to declare proof of coverage.

4.1 Commercial General Liability (CGL) and Automobile Liability

In the below table, check off the boxes as per the given insurance requirements. You do not need to fill in the insurer(s), policy number, dates or deductible as this will be completed by the insurer. On the right-hand side of the table, fill in the required limits with respect to required coverage. If you do not need a specific coverage under CGL (such as non-owned auto), leave the limit requirement as blank. Insurance requirements should be outlined in the agreement.

Commercial general liability (CGL) is a type of insurance policy that provides coverage to a business for bodily injury, personal injury and property damage caused by the business’ operations, products, or injury that occurs on the business’ premises. Clauses under CGL usually include, among others, non-owned auto liability, employer’s liability, and sudden and accidental pollution liability. Other insurance requirements are to be listed at the bottom of the table, explained in section 1.7.

4.2 Umbrella Liability

Umbrella insurance is a type of extra liability insurance. This type of insurance policy is designed to offer extra levels of liability protection to any underlying insurance policies. TRCA accepts Umbrella Liability policies combined with underlying policy limits to meet insurance requirements. The underlying policy must be specified in the section indicated below

4.3 Other types of insurance

At the bottom of the table are blank fields where other types of insurance can be listed, as required. Examples include professional liability or contractor’s pollution. Requirements will be outlined in the contract or project documents, along with their respective required limits.

The following section provides guidelines on how to request a certificate of insurance where your contractor or partner is required to show proof of coverage. The Vendor or Contractor COI can be found on Bulletin Board and on the Hub.

- Send a copy of TRCA’s Vendor or Contractor COI to the third party and ask them to complete it, and have it certified by their insurer before contract signing or the project start date, whichever is earlier. The correct limits should be shown in your document.

- Once it has been returned, review the COI to ensure it complies with the contract requirements, specifically limits and coverages as specified. The Vendor or Contractor COI must be completed without any changes to be considered valid. Any proposed changes must be reviewed by Risk Management/Legal.

5.1 What to do with the third party certificate if it is tied to a Procurement Agreement Document?

Once you receive the COI from the third party, attach a copy to the corresponding agreement in the Procurement Database (please refer to Section 2).

5.2 What to do with the third party certificate if it is not tied to a Procurement Agreement Document?

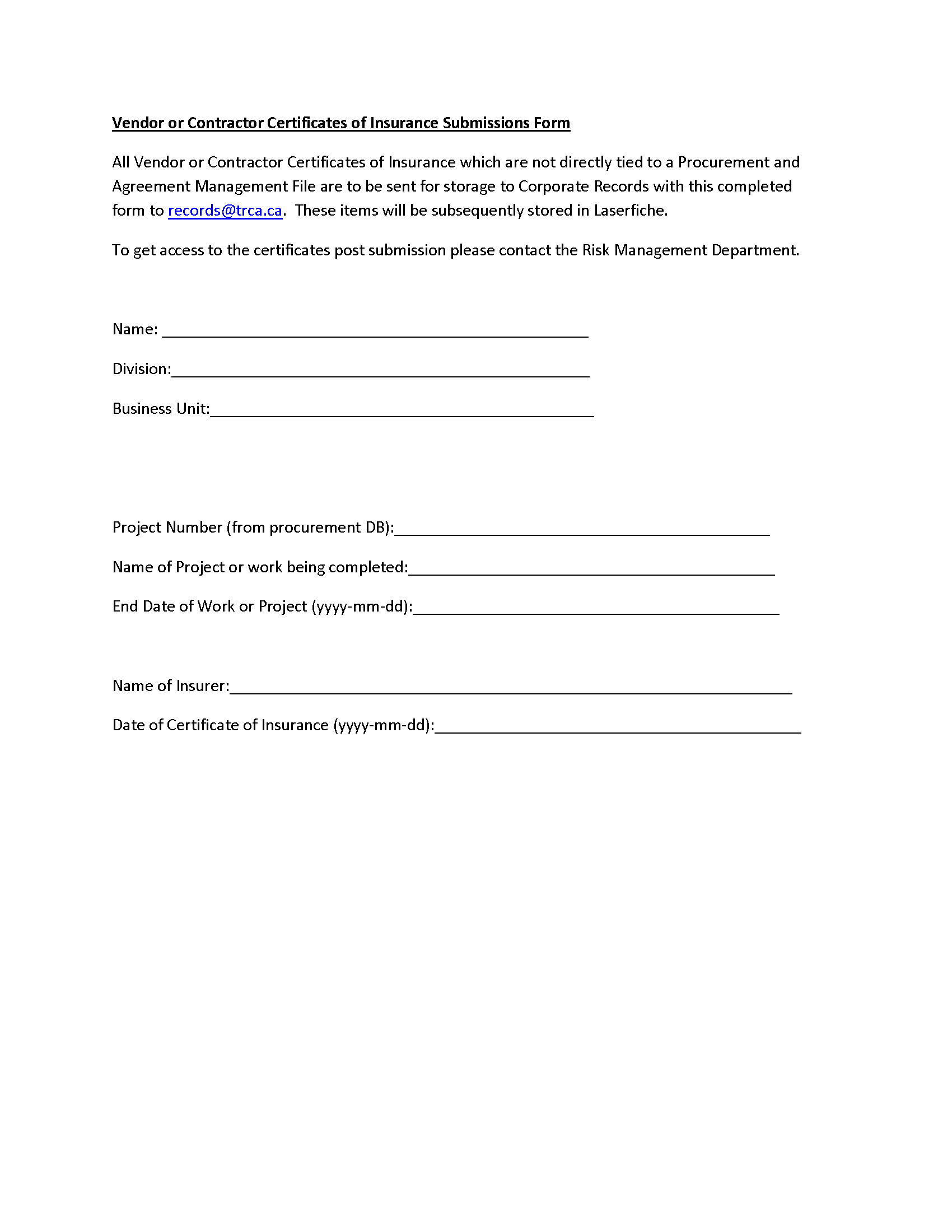

All Third Party Certificates of Insurance which are not directly tied to a Procurement and Agreement Management File are to be sent for storage to Corporate Records with this completed form to records@trca.ca, along with the form found in “Appendix C – Third Party Certificates of Insurance Submissions Form”. These items will be subsequently stored in Laserfiche.

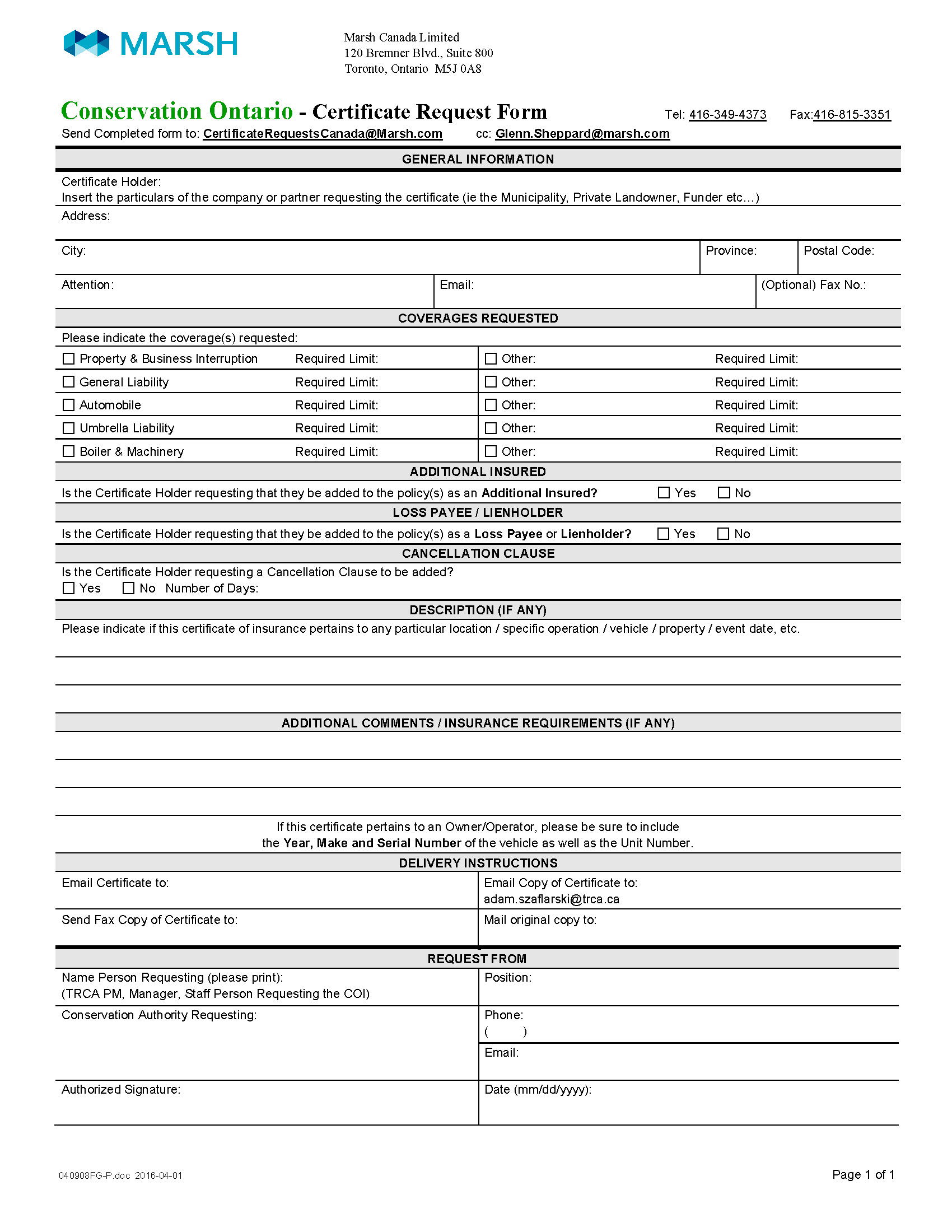

The following section provides guidelines on how to request a certificate of insurance where TRCA is required to provide proof of coverage. Certificate of insurance request forms can be found on Bulletin Board and on the Hub.

- Complete TRCA’s COI Request Form to the best of your ability.

- Include at a minimum the following information: the date of the project, how long it will last, where it will take place, what operations will be undertaken and the required coverage amounts.

- Keep the form in Microsoft Word format (in case Risk Management needs to make changes, don’t worry about signatures).

- Include in the subject heading of the email: the date for which the COI is needed as well as the project name.

For example: your team needs a COI for a the “rotary water festival” on May 15, 2022, the subject should read: “COI: May 15, 2022 Rotary Water Festival”

- If there are any special instructions, please indicate this in the email and attach any pertinent documents.

- If the form needs to be completed on another party’s form, please include a copy of the relevant form in the request.

- Send the completed request or any questions you might have to insurancerequest@trca.ca.

Risk Management will endeavor to have your requested certificate back to you within 2 weeks of your completed request email. Please be aware that third party forms will require review by TRCA’s insurers and may take longer. Please plan accordingly.

Additional insured: A person or organization, not normally included as an insured party on a policy that is added through an endorsement. The Additional Insured is granted certain rights to make claim against the insurance policy, but usually only due to liabilities arising out of the operations of the primary policy holder.

Aggregate: A limit in an insurance policy stipulating the most it will pay for all covered losses sustained during a specified policy period, usually a year.

Automobile Insurance: Coverage that insures against damage and liability stemming from the use of automobiles.

Aviation Insurance Policies: Policies that cover Claims or suits that arise out of the ownership, maintenance, or use of aircraft. These are losses that are typically excluded under most general liability policies.

Boiler and Machinery: Coverage for loss due to mechanical or electrical breakdown of equipment. Coverage applies to the cost to repair or replace the equipment and any other property damaged by the equipment breakdown. Resulting business income and extra expense loss is often covered as well.

Certificate holder: The entity that is provided a certificate of insurance as evidence of the insurance maintained by another entity, usually listed in the space provided in standard certificate forms.

Commercial General Liability (CGL) Policy: A standard insurance policy issued to entities to protect them against liability for bodily injury, property damage, personal injury, medical expenses and tenants liability stemming from their operations. The CGL typically excludes liabilities arising from the operations of aircraft and watercraft and professional liability (see below).

Completed Operations: Work of the insured that is finished, but that might still represent a liability. For example, a completed deck that falls down upon use. The CGL typically includes coverage for property injury and property damage that Completed Operations might cause.

Contractual Liability: Liability imposed on an entity by the terms of a contract. As used in insurance, the term refers not to all contractually imposed liability but to the assumption of the other contracting party’s liability under certain conditions.

Cyber Extortion: A type of online crime in which a criminal threatens to damage or shut down a company’s website, e-mail server, or computer system or threatens to expose electronic data or information belonging to the company unless the company pays the criminal a specific ransom amount.

Cyberspace liability: A term used to describe the liability exposures encountered when communicating or conducting business online. Online communication tools could result in claims alleging breaches of privacy rights, infringement or misappropriation of intellectual property, employment discrimination, violations of obscenity laws, the spreading of computer viruses, and defamation. Media liability policies are available to cover these exposures.

Cyber and Privacy Insurance: Cyber and Privacy insurance policies cover a business’ liability for a data breach in which the firm’s customers’ personal information, such as Social Security or credit card numbers.

Deductible: The amount an insured party will need to contribute to a loss before the insurer pays for a loss.

Insured: The person(s) protected under an insurance contract.

Insurer: The insurance company that undertakes to indemnify for losses and perform other insurance-related operations.

Marine: A type of insurance designed to provide coverage for the transportation of goods either over water or by land (often called “Inland Marine”). Marine insurance can also refer to coverage for damage to the vessel being used to transport cargo and to the liability for third parties arising out of the process. The former is often referred to as “Hull Insurance”, and the latter is often referred to as “Marine Liability Insurance”.

Named Insured: Any person, firm, or organization, or any of its members specifically designated by name as an insured(s) in an insurance policy, as distinguished from others that, although unnamed, fall within the policy definition of an “insured”.

Pollution Liability: Liability stemming from the contamination of an environment by substances regarded as pollutants or from the release of pollutants. Liability from pollution is normally excluded to some degree by the general, auto, and umbrella liability policies.

Professional and Errors and Omissions Insurance: A type of liability coverage designed to protect professionals against liability incurred as a result of errors and omissions in performing their professional services.

Property: First-party insurance that indemnifies the owner or user of property for its loss, or the loss of its income-producing ability, when the loss or damage is caused by a covered peril, such as fire or explosion.

Third party: A person or entity other than the insured and the insurer. In liability insurance, the insurer provides defense against claims or suits brought by third parties.

Umbrella Liability Policy: A policy issued to provide limits in excess of an underlying liability policy.