2022 Pay and Pension Update

January 4, 2022

Hi everyone, wishing you all a Happy New Year, hope you had some time to enjoy the holidays.

Below is a summary of some payroll related items that will affect your pay in 2022, along with some additional pay related reminders.

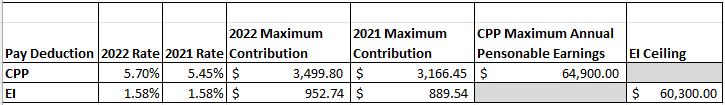

1) Current Pay Deductions – CPP (Canadian Pension Plan), EI (Employment Insurance) and Income Taxes

Below is a summary of the rate changes and maximum contributions/premiums applicable for your 2022 pay, compared to 2021:

Once the CPP Maximum Annual Pensionable Earnings and EI Ceiling are reached in 2022, CPP and EI deductions will not be deducted for the remainder of 2022. If you reached the CPP and EI maximums during 2021, 2022 deductions will commence with your January 7, 2022 pay.

Income tax deductions are determined by the information contained on the TD1 and TD1ON forms (Personal Tax Credits Returns) we have on file for you and stored in Dayforce electronically. If you claim something other than the Basic Personal amount on your TD1 forms, or you wish to have additional taxes deducted at source, you must complete new Federal and Provincial TD1 forms for 2022 in Dayforce. You can view your Federal and Provincial claim amounts in the top right-hand corner of your pay stub. Please retrieve and review your pay stubs in Dayforce. Pay stubs are accessible from the “Earnings” icon on the blue navigation panel on the home landing page.

The basic personal exemption amounts for 2022 are as follows:

![]()

Below is a summary of the personal tax credit categories for consideration:

|

|

|

|

|

|

|

|

|

|

|

|

To update your forms in Dayforce:

1) Logon to Dayforce.

2) On your home landing page, click on the “Forms” icon on the top blue navigation panel.

3) Click on each of the Federal and Provincial Tax forms to review and update your information. Ensure you electronically sign the form before submitting. Payroll will receive automated notifications of any changes.

2) Retirement Planning – OMERS Pension Plan

If you are not a continuous full-time permanent employee, and considered to be an Other Than Continuous Full-Time Employee (OTCFT employee), as defined by OMERS, you are eligible to join the pension plan, if during each of the two immediately preceding calendar years (2021 & 2020) one of the following two conditions have been met:

1) you have worked at least 700 hours (including overtime) with any participating OMERS employer; OR

2) you have earned, including overtime and vacation pay, at least 35% of the year’s YMPE (approximately $21,560 in 2021) with any participating employer.

The payroll team has reviewed the earnings records for 2021 & 2020 and has emailed employees who are eligible to join the plan based on hours worked or pay earned for the last two years. However, if you have worked for another participating OMERS employer during the last two calendar years, please contact the payroll team to confirm your eligibility to participate in the plan, at payroll@trca.ca

Maximizing your Pension with Eligible Service:

If you are already a participating member in a pension plan, do ensure that your eligible service has been identified to OMERS. Eligible service is defined as a period of employment with an OMERS employer (i.e., certain other CAs, Ontario municipalities etc.) and can also include a non-teaching school (and school board) employers, during which time you did not contribute to the pension plan or for which time a refund of contributions upon termination of employment was received.

Eligible service is a factor used to determine when you may retire with an unreduced pension or the amount of penalty that will apply in certain early retirement situations. The longer you wait to provide OMERS with this information, the greater the likelihood your other employer will have difficulty in confirming your employment history. Check your annual personalized OMERS pension report to confirm that eligible service is properly reported. If not, contact OMERS directly to receive instructions on updating your record. OMERS contact information for Member Services is Phone: (416) 369.2444, www.omers.ca

3) Your 2021 T4 Form

Instructions to retrieve your T4 Form electronically will be communicated before the end of February.

Please ensure that you review your current address in Dayforce.

Thank you,

John Arcella

Controller, Finance